Before anyone uttered a word about the proposal in public, people inside major federal offices were already sensing that something was off.

Drafts that had circulated for weeks suddenly vanished from shared folders. Conference rooms—usually empty after sunset—were booked for private gatherings that stretched late into the night. Analysts who routinely worked with tariff datasets were informed their access had been “temporarily suspended.”

No one wanted to draw attention by asking questions, but the message was clear: a significant economic announcement was being engineered in silence, and those behind it intended to unveil it at the most politically advantageous moment.

The headline number sounds almost surreal. A $2,000 payment for most Americans, entirely financed by tariffs imposed on imported goods. With a handful of provocative statements, Donald Trump turned a niche policy idea into a sweeping promise of instant financial relief.

Supporters call it innovative and patriotic. Critics argue it’s risky, vague, or even unworkable. The truth is that the mechanics remain murky—who would qualify for the payouts, how the funds would be delivered, and whether tariff revenue could reliably cover the cost year after year. The idea taps into a widespread hunger for stability in a country wrestling with inflation, economic uncertainty, and political division.

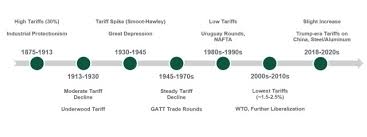

A “tariff dividend”—foreign companies pay, American families collect—sounds simple. But real-world tariffs almost never fall neatly on foreign producers. Economists warn that higher import taxes typically surface later as higher consumer prices, hidden inside everything from groceries to utility bills.

The unresolved issues are substantial. How high must income be before a household is excluded? Would the benefit arrive as a monthly direct deposit, an annual tax credit, or some new form of government rebate? And could tariff collections alone sustain such a large-scale program, or would it quietly depend on deficit spending, temporary accounting shifts, or emergency reserves?

For now, the proposal functions best as political ammunition—part policy experiment, part campaign message, and part test of whether voters are willing to trade long-term budget clarity for immediate financial relief.

Conclusion

In the end, the proposal’s future depends on whether the public sees it as a bold rethinking of trade policy or as a flashy but fragile promise built on optimistic math. Until the fine print is revealed, it remains an enticing yet uncertain vision—one that could reshape the economy or unravel the moment its assumptions meet reality.