You might think tariffs are only a concern for big corporations and government policy experts, but recent developments are hitting home in a way that’s hard to ignore—and affecting nearly everyone in the United States.

Under the Trump administration’s sweeping trade policies, tariffs have been imposed on nearly every country around the world, and that includes even the most remote places like the Heard Island and McDonald Islands—territories so isolated they’re mainly inhabited by penguins and seals.

It’s a move that’s left economists scratching their heads—and everyday Americans wondering how the price tags at their favorite stores got so high, so fast.

For the first time in U.S. history, a uniform 10% tariff has been applied across the board, sparing no one and nothing, no matter how far-flung.

Michael Coon, an associate professor of economics at the University of Tampa, called the decision “unusual” and “a sign of economic desperation that you typically only see in lower-income countries.”

“The only place you really see something like that,” Coon explained to HuffPost, “is in countries that don’t have the infrastructure to collect income taxes. It’s easier to collect tariffs at the port because you have to set up a customs office on the dock.”

And that’s exactly what’s happening now. As tariffs on imported goods roll in, Americans are paying the price—literally—often before they even bring the products home.

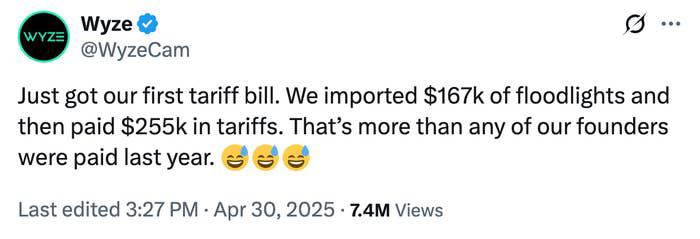

Consider the tech firm Wyze Cam, based in Washington, which shared a stunning invoice: they paid $255,000 in tariffs and $579.23 in ‘other fees’ just to import $167,000 worth of Wyze Cams. The math is mind-boggling—an effective tax rate that nearly doubled the cost of the goods before they could even hit store shelves.

And they’re not alone. Adafruit Industries, a beloved source for hobbyists and hardware tinkerers, revealed that they, too, have been forced to jack up their prices just to stay afloat. “We’re no stranger to tariff bills, although they’ve definitely ramped up over the last two months,” Adafruit wrote in a heartfelt statement to their customers. “However, this is our first ‘big bill,’ where a large portion was subjected to a 125%+20%+25% import markup.”

They explained that unlike other taxes—like sales tax, which is collected at the point of sale and remitted later—tariffs hit hard and fast. “Tariff taxes are paid before we sell any of the products,” they wrote. “They’re due within a week of receipt, which has a big impact on cash flow.” For small businesses, that’s a nightmare scenario: paying steep fees upfront on products that might take weeks or months to sell, if at all.

The Adafruit team also highlighted a frustrating truth: even if they wanted to avoid the tariffs by sourcing items elsewhere or producing them domestically, they often can’t. Many of their products are protected by intellectual property laws or produced by vendors they simply can’t replace overnight.

“In this particular case, we’re buying from a vendor, not a factory,” they explained. “We can’t second-source the items. And these products were booked and manufactured many months ago, before the tariffs were in place.”

They’re now exploring whether they can request a reclassification on some of their items to avoid the 125% ‘reciprocal tariff’, but they’re realistic about their odds. “There’s no assurance that it will succeed, and even if it does, it will be many, many months until we could see a refund.”

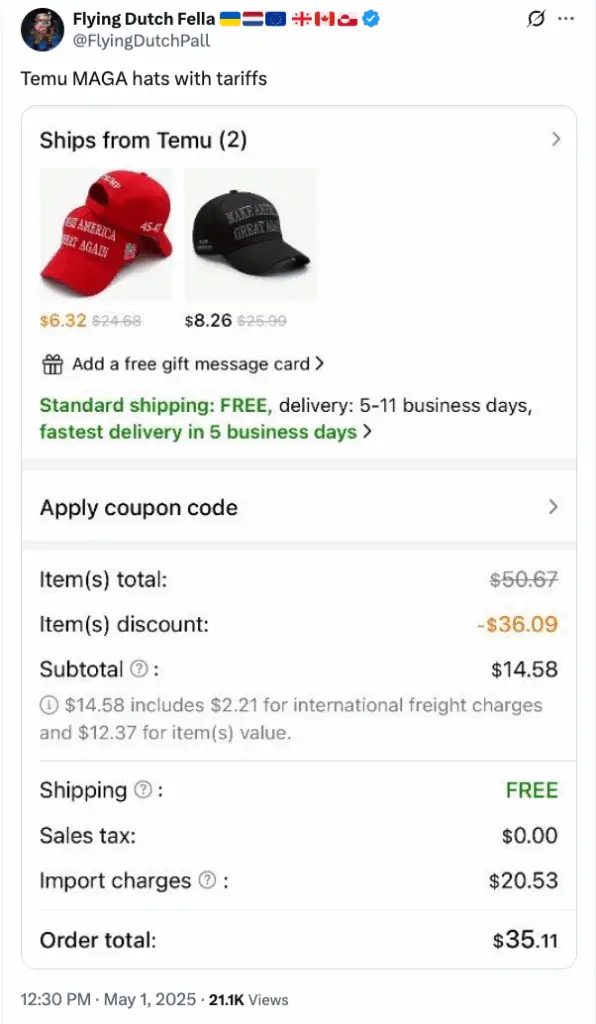

While big businesses might be able to weather this storm, everyday people are starting to feel the crunch too. Social media is buzzing with people sharing photos of receipts that show jaw-dropping fees they never expected to pay.

One Reddit user posted about buying a pre-owned Louis Vuitton wallet from a Japanese seller. “I paid $80 for the wallet, plus U.S. sales tax—$116.91 total,” the user wrote. “Then I got a notice from DHL that my tariff fees are $83.10!” For many, that’s nearly doubling the cost of an item they thought was a good deal.

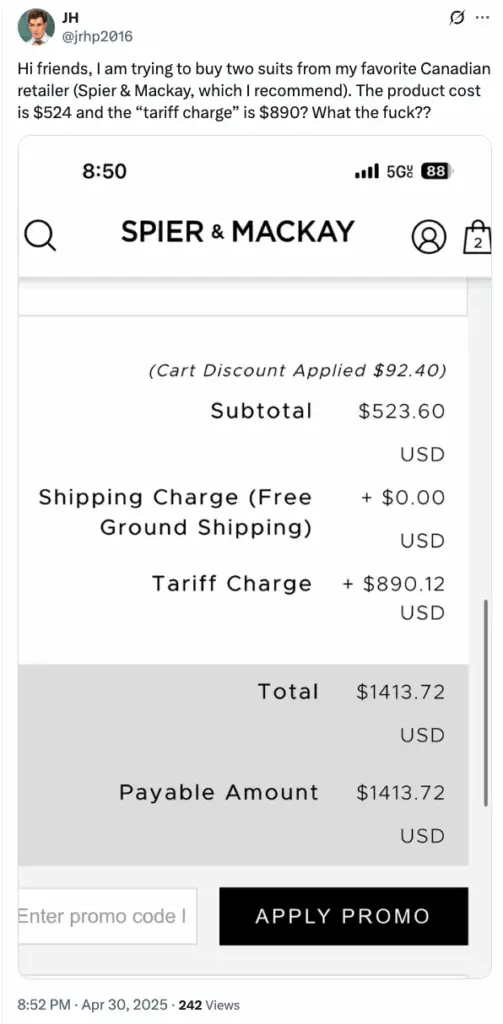

It’s not just fashion lovers feeling the squeeze. One shopper complained about the price of a suit from his favorite Canadian retailer. The cost had soared beyond what he could afford, forcing him to consider postponing his purchase—if not canceling it altogether.

Even healthcare is not immune. A hospital administrator in Ohio, who asked to remain anonymous, shared that crucial medical supplies—like surgical gloves and diagnostic equipment—are also subject to tariffs. “We’re looking at price increases that we simply can’t absorb,” she explained. “It means higher costs for patients, higher insurance premiums, and fewer resources to invest in patient care.”

In some cases, businesses have decided to simply pause shipping to the U.S. altogether, unable to justify the skyrocketing costs or the unpredictable red tape.

All of this leaves one fundamental question echoing through the halls of commerce and conversation: How much longer can Americans shoulder the burden of these tariffs before something breaks?

What started as an attempt to boost domestic industries has, for many, turned into a cascade of higher prices, disrupted supply chains, and daily frustration. Yet amid the chaos, stories like those from Adafruit and Wyze Cam—and the everyday people sharing their receipts online—remind us that behind every invoice is a human being trying to navigate a complicated world.

This is not just about economics; it’s about the small businesses that give communities their character, the parents saving for school clothes, the entrepreneurs building tomorrow’s dreams. Tariffs may seem like an abstract policy decision, but their impact is deeply personal—and it’s reshaping lives one receipt at a time.

Please SHARE this article with your friends and family on Facebook, so more people understand what these tariffs mean for all of us.